Are you curious about where Ethereum is headed? Whether you’re an investor eyeing the next big opportunity, a developer building decentralized apps, or simply a blockchain enthusiast, the future of Ethereum is a topic that sparks intrigue—and a little uncertainty. With its volatile price movements, groundbreaking technological upgrades, and rising competition, predicting Ethereum projections can feel like gazing into a crystal ball. But don’t worry—this article is here to cut through the noise. We’ll explore Ethereum’s price forecasts, adoption trends, and technological advancements, giving you actionable insights to navigate its future in 2025 and beyond.

Table of Contents

The Current State of Ethereum

Ethereum, launched in 2015 by Vitalik Buterin and his team, is the world’s second-largest cryptocurrency by market capitalization, trailing only Bitcoin. It’s more than just a digital currency—it’s a decentralized platform that powers smart contracts, decentralized finance (DeFi), and non-fungible tokens (NFTs). As of mid-2025, Ethereum continues to lead the blockchain space, despite challenges like high transaction fees and scalability limitations.

The shift to Ethereum 2.0, completed with “The Merge” in 2022, transitioned the network from proof-of-work (PoW) to proof-of-stake (PoS), slashing its energy use by over 99%. This upgrade laid the groundwork for future scalability improvements, but Ethereum still faces competition from faster, cheaper blockchains like Solana and Avalanche.

Ethereum Snapshot (July 2025):

- Price: ~$2,500

- Market Cap: ~$300 billion

- Daily Transactions: ~1.2 million

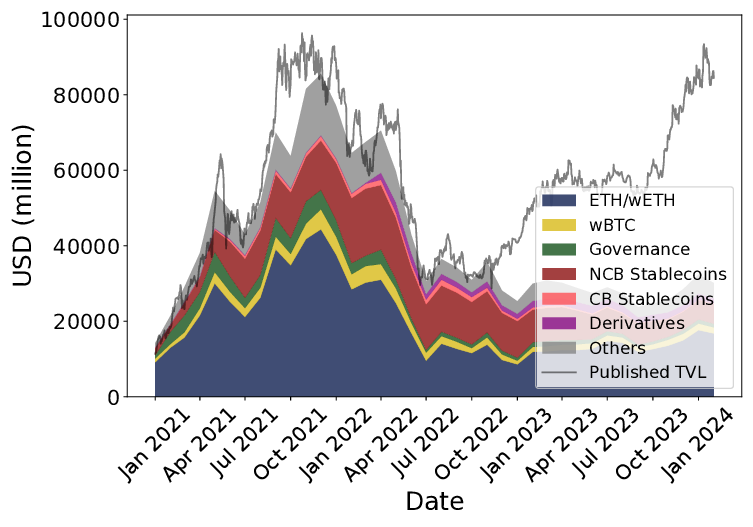

- DeFi Total Value Locked (TVL): ~$50 billion

These numbers set the stage for our exploration of Ethereum projections. So, what’s next?

Key Factors Shaping Ethereum’s Future

Ethereum’s trajectory hinges on several dynamic factors. Understanding these can help you make sense of Ethereum future trends and forecasts.

Technological Upgrades

Ethereum’s roadmap includes ambitious upgrades like sharding and enhanced Layer 2 solutions. These aim to boost transaction speeds and reduce costs, addressing long-standing criticisms. The success of these upgrades will be a major driver of Ethereum’s growth.

Regulatory Landscape

Governments worldwide are scrutinizing cryptocurrencies. In 2025, regulatory clarity—especially in the U.S. and EU—could either propel Ethereum forward or create roadblocks. For instance, if Ethereum is classified as a commodity rather than a security, it could see a surge in institutional investment.

Competition

Newer blockchains like Solana (with 65,000 TPS) and Polkadot (with interoperability focus) challenge Ethereum’s dominance. Ethereum must innovate to retain its edge in DeFi and NFT markets.

Institutional Adoption

Big players like BlackRock and Fidelity are warming to Ethereum, especially after Ethereum ETF approvals in 2024. This trend could amplify demand and stabilize prices.

Economic Climate

Cryptocurrencies are sensitive to macroeconomic shifts. Inflation, interest rates, and geopolitical events can sway investor sentiment, impacting Ethereum market analysis.

Ethereum Price Projections

Predicting crypto prices is tricky, but analysts use historical data, market trends, and expert insights to forecast Ethereum price forecasts. Here’s what the numbers suggest.

Short-Term Outlook (2025)

- Bullish Case: If upgrades roll out smoothly and institutional money flows in, ETH could hit $5,000 by year-end.

- Bearish Case: Regulatory setbacks or a crypto market downturn might push ETH down to $1,500.

Long-Term Outlook (2030)

- Optimistic Scenario: Widespread adoption of dApps and Web3 could drive ETH past $10,000.

- Conservative Estimate: With moderate growth and competition, ETH might settle around $3,000.

Ethereum Price Projection Table

| Year | Bullish | Bearish | Average |

|---|---|---|---|

| 2025 | $5,000 | $1,500 | $3,250 |

| 2027 | $8,000 | $2,500 | $5,250 |

| 2030 | $10,000 | $3,000 | $6,500 |

Source: Aggregated from crypto analyst reports and market trends.

Real-World Example: When Ethereum 2.0’s merge was completed in 2022, ETH surged 20% in a month, showing how upgrades can spark price rallies.

Adoption and Usage Projections

Beyond price, Ethereum’s success lies in its adoption and real-world utility. Here’s what Ethereum adoption rates might look like.

DeFi and NFTs

Ethereum hosts over 70% of DeFi activity, with TVL projected to double to $100 billion by 2027. However, NFT minting might shift to cheaper chains unless Ethereum’s fees drop.

Enterprise Use Cases

Companies like Microsoft (Azure Blockchain) and ConsenSys (enterprise solutions) are leveraging Ethereum. By 2030, it could underpin supply chains, digital IDs, and more.

User Growth

Ethereum’s wallet addresses grew from 40 million in 2022 to 50 million in 2023. Projections suggest this could hit 100 million by 2025 as Web3 gains traction.

Case Study: In 2021, Axie Infinity’s NFT game on Ethereum onboarded millions of users, showcasing how dApps can drive adoption.

Technological Advancements Driving Ethereum

Ethereum’s tech roadmap is its secret weapon. Here are the game-changers to watch.

Sharding

Set for full rollout by 2026, sharding splits the network into smaller “shards” to process transactions in parallel. This could boost Ethereum’s capacity to 100,000 TPS.

Layer 2 Scaling

Solutions like Optimism and Arbitrum offload transactions from the main chain, cutting costs. By 2025, these could become seamless, enhancing user experience.

Zero-Knowledge Proofs (ZKPs)

ZKPs, used in projects like zkSync, improve privacy and efficiency. They’re poised to become standard by 2030, making Ethereum more versatile.

Also Read: A 2-minute explainer on sharding and its impact on Ethereum’s scalability.

Frequently Asked Questions (FAQs)

1. What factors influence Ethereum’s price projections?

Ethereum’s price is shaped by a mix of internal and external forces. Technological upgrades, like sharding or Layer 2 advancements, can boost investor confidence and drive demand. Regulatory decisions—such as whether the SEC deems ETH a security—can sway market sentiment. Competition from faster blockchains like Solana also pressures Ethereum to innovate. Macroeconomic factors, like inflation or stock market trends, play a role too, as crypto often mirrors risk asset behavior. Historically, events like the 2022 Merge have triggered short-term rallies, showing how these factors interplay. Keeping an eye on news and market analysis is key to anticipating price shifts.

2. How do technological advancements affect Ethereum’s future?

Tech upgrades are Ethereum’s lifeline. The shift to proof-of-stake in 2022 cut energy use dramatically, addressing environmental critiques. Upcoming features like sharding will tackle scalability, potentially making Ethereum as fast as competitors. Layer 2 solutions already reduce fees, drawing more users to DeFi and NFTs. These advancements don’t just improve performance—they attract developers and businesses, fueling adoption. For example, Arbitrum’s growth in 2023 showed how scaling can revive interest. If Ethereum keeps innovating, it could solidify its lead in the blockchain race.

3. What are the potential risks and challenges for Ethereum?

Ethereum isn’t without risks. Regulatory uncertainty looms large—harsh laws could stifle growth, especially in key markets like the U.S. Competition is fierce, with Solana and Avalanche offering cheaper, faster alternatives. Technical hiccups, like delays in sharding, could erode trust. Security is another concern; while rare, smart contract exploits have cost millions in the past. Market volatility adds unpredictability—think of the 2022 crypto winter that saw ETH drop 60%. Balancing innovation with stability will be Ethereum’s biggest challenge.

4. How can I stay updated on Ethereum’s latest developments?

Staying in the loop is easier than you think. Follow trusted crypto news sites like CoinDesk or CoinTelegraph for daily updates. Join Ethereum communities on Reddit (r/ethereum) or Discord for real-time discussions. The Ethereum Foundation’s blog and Twitter (@ethereum) offer official insights. For deeper dives, explore whitepapers or attend events like ETHGlobal. Tools like Etherscan can track network activity, while newsletters from analysts like Messari keep you ahead of trends. It’s about blending primary sources with community buzz.

5. What are some expert opinions on Ethereum’s future?

Experts are split but optimistic. Vitalik Buterin sees Ethereum as the backbone of Web3, predicting dominance if upgrades succeed. Analysts at Bloomberg forecast ETH hitting $6,000 by 2027, citing institutional adoption. However, skeptics like those at CoinBureau warn that competitors could chip away at Ethereum’s market share without faster progress. A balanced view? Ethereum’s ecosystem is unmatched, but execution is everything. Check reports from firms like Delphi Digital for data-driven takes.

6. How does Ethereum compare to other blockchain platforms?

Ethereum shines with its first-mover advantage and vast developer community—over 4,000 dApps call it home. Solana boasts 65,000 TPS to Ethereum’s 15, but lacks Ethereum’s battle-tested reliability. Avalanche offers sub-second finality, appealing to traders, while Polkadot focuses on interoperability. Ethereum’s edge lies in its ecosystem and upgrades; sharding could close the speed gap. Yet, its $20 average gas fees dwarf Solana’s $0.01. It’s a trade-off between maturity and agility—Ethereum leads, but rivals are nipping at its heels.

Conclusion

Ethereum’s future is a tale of potential and pitfalls. Its price could soar with institutional backing and tech breakthroughs, or falter under regulatory and competitive pressures. Adoption is set to grow, fueled by DeFi, NFTs, and enterprise use, while innovations like sharding promise a faster, cheaper network. Whether you’re investing or exploring, understanding these Ethereum projections equips you to act wisely.

What’s your take? Drop a comment with your predictions, share this article with fellow crypto fans, or sign up for our newsletter for more blockchain insights!

What’s New in 2025

Ethereum’s 2025 is packed with updates:

- EIP-4844 (Proto-Danksharding): Lowers Layer 2 costs, paving the way for full sharding.

- Verifiable Delay Functions (VDFs): Boosts PoS security and fairness.

- ENS Enhancements: Simplifies wallet addressing for mainstream use.

These changes signal Ethereum’s drive to stay ahead in the blockchain game.