In a world filled with uncertainty—whether it’s the outcome of a political election, the price of Bitcoin, or even the weather—knowing what’s coming next feels like an impossible dream. What if there was a way to tap into the wisdom of the crowd and turn speculation into actionable insights? That’s where Polymarket comes in, a decentralized prediction market platform that’s changing how we bet on the future. Built on blockchain technology, Polymarket offers a transparent, low-cost way to predict real-world events, from global politics to cryptocurrency trends.

In this 2000+ word guide, we’ll dive deep into what Polymarket is, how it works, and why it’s making waves in 2025. You’ll discover its benefits, risks, and real-world examples, all while learning how it aligns with the growing world of decentralized finance. Whether you’re a curious beginner or a seasoned bettor, this article will equip you with everything you need to know about Polymarket—and maybe even inspire you to try it yourself.

Table of Contents

What is Polymarket?

Polymarket is a decentralized prediction market platform where users can wager on the outcomes of real-world events. Unlike traditional betting sites, it operates on the Polygon network, a layer-2 solution for Ethereum, ensuring fast transactions and minimal fees. Prediction markets allow people to buy and sell shares in the potential outcomes of events—like “Will a new climate policy pass in 2025?”—with prices reflecting the collective belief in each possibility.

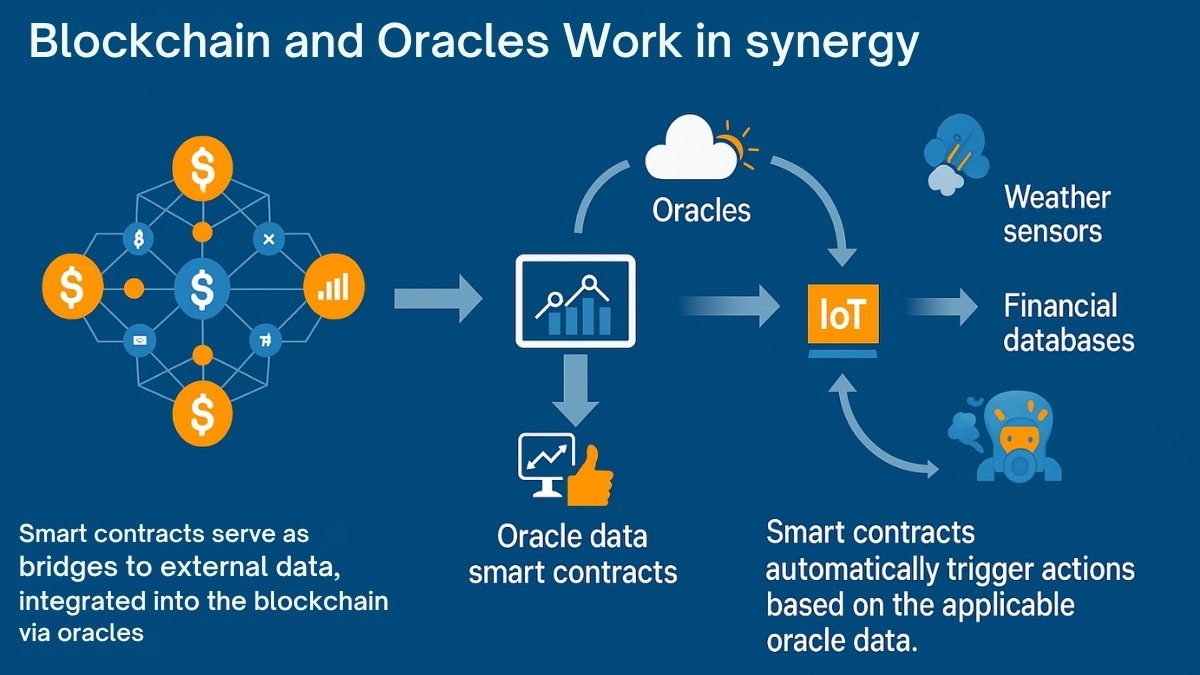

Polymarket stands out by using blockchain technology and the UMA (Universal Market Access) protocol as its oracle system to resolve market outcomes. This decentralized approach ensures no single entity controls the results, making it a transparent alternative to centralized betting platforms. From political forecasts to financial speculation, Polymarket has become a hub for those seeking insights into the future through blockchain betting.

How Does Polymarket Work?

Polymarket’s process is simple yet powerful. Here’s how it operates:

- Market Creation: Anyone can propose a market by asking a yes-or-no question about a future event (e.g., “Will Ethereum hit $5,000 this year?”). The creator defines clear resolution criteria for how the outcome will be determined.

- Trading Shares: Users buy shares in either “Yes” or “No” outcomes. Share prices range from $0 to $1, fluctuating based on demand and reflecting the market’s confidence in each outcome.

- Oracle Resolution: After the event occurs, the UMA oracle system steps in. A decentralized network of UMA token holders votes on the outcome using real-world data, ensuring fairness and transparency.

- Payouts: Once resolved, users holding shares in the correct outcome redeem them for $1 each, paid in USDC, a stablecoin tied to the U.S. dollar.

This system leverages event outcomes and the power of the crowd, all secured by blockchain technology, to create a unique betting experience.

Why Use Polymarket? Key Benefits

Polymarket offers distinct advantages over traditional platforms. Here’s why it’s gaining traction:

- Decentralized Control: No central authority can manipulate outcomes or censor markets, unlike traditional betting sites.

- Low Costs: Thanks to Polygon’s efficiency, transaction fees are minimal—perfect for small bets or frequent trades.

- Transparency: Every trade and resolution is recorded on the blockchain, open for anyone to verify.

- Global Reach: Accessible worldwide with just a crypto wallet and internet connection.

- Variety: Markets span politics, finance, sports, and more, catering to diverse interests.

These features make Polymarket a standout in the prediction markets space, appealing to users who value fairness and affordability.

Real-World Examples of Polymarket in Action

Let’s explore how Polymarket works in practice with two notable case studies.

The Zelenskyy Suit Market

One high-profile market asked, “Will Ukrainian President Volodymyr Zelenskyy wear a suit during a specific public appearance?” With over $142 million in trading volume, it drew massive attention. Post-event, reputable sources like Reuters and BBC reported Zelenskyy didn’t wear a suit, yet UMA oracle voters initially leaned toward “Yes.” After backlash, the outcome was corrected, but it raised questions about oracle reliability in blockchain betting.

The Trump Mineral Deal Market

Another market speculated, “Will Donald Trump announce a mineral rights deal by a set date?” Resolved as “No,” some users contested it, citing Trump’s public statements. This again spotlighted potential flaws in the UMA system, where large token holders might sway results.

These cases show Polymarket’s potential—and its challenges—highlighting the need for trust in its UMA oracle system.

Read More: – ASML Stock Analysis 2025: Is It a Good Investment?

The Tech Powering Polymarket

Polymarket’s innovation lies in its technology stack. Here’s what drives it:

Blockchain on Polygon

Built on Polygon, Polymarket enjoys Ethereum’s security with faster, cheaper transactions. Smart contracts automate market creation and payouts, ensuring a tamper-proof experience.

UMA Oracle System

The UMA oracle fetches real-world data for market resolutions. Token holders vote on outcomes, aiming for decentralization. However, controversies like the Zelenskyy market suggest room for improvement.

USDC Payments

Using USDC, Polymarket offers stability in a volatile crypto world, making it beginner-friendly and practical for decentralized finance enthusiasts.

Risks to Understand Before Using Polymarket

Polymarket isn’t perfect. Here are key risks:

- Oracle Issues: Voting disputes can lead to incorrect resolutions, as seen in past markets.

- Regulation: Operating in a legal gray area, it may face future restrictions.

- Liquidity: Niche markets might lack enough traders, affecting share prices.

- User Responsibility: Mistakes like losing wallet access can mean lost funds.

Awareness of these risks ensures a safer experience with event outcomes.

Also Read: – Ethereum Explained: A Comprehensive Guide for 2025

Polymarket vs. Traditional Betting: A Comparison

| Feature | Polymarket | Traditional Platforms |

|---|---|---|

| Control | Decentralized | Centralized |

| Fees | Low (Polygon-based) | Often high |

| Transparency | Blockchain-verified | Limited visibility |

| Access | Global | Region-restricted |

| Resolution | Oracle-based | Operator-decided |

This table shows why Polymarket is a game-changer for prediction markets.

What’s New for Polymarket in 2025?

In 2025, Polymarket is poised for growth:

- Oracle Upgrades: Efforts to refine UMA or adopt alternatives like Chainlink could boost reliability.

- AI Integration: Predictive analytics might enhance user insights.

- Regulatory Shifts: Clearer laws could legitimize or challenge its operations.

- New Markets: Expect topics like climate predictions or tech breakthroughs.

These trends signal an exciting future for blockchain betting.

Frequently Asked Questions (FAQs)

1. How Do I Get Started with Polymarket?

Starting with Polymarket is easy if you’re crypto-savvy. You’ll need a wallet like MetaMask, set up for the Polygon network. Next, acquire USDC from an exchange (e.g., Coinbase), transfer it to your wallet, and connect to Polymarket’s site. Browse markets, pick one, and buy shares in your predicted outcome.

New to crypto? Take time to learn wallet security—lost keys mean lost funds. Start small to test the platform, and always check market rules. It’s a hands-on way to dive into prediction markets, but user responsibility is key.

2. How Does the UMA Oracle System Work?

The UMA oracle resolves Polymarket outcomes by relying on decentralized voting. After an event, UMA token holders review evidence (e.g., news reports) and vote on the result. A majority decides the outcome, and payouts follow. Disputes can extend this process, adding scrutiny.

While designed for fairness, the system’s human element has flaws. Large token holders can influence votes, as seen in controversial resolutions. It’s a trade-off for decentralization, but understanding this helps you pick markets wisely.

3. What Are the Risks of Using Polymarket?

Risks include oracle errors, where voting misaligns with facts, costing you money. Regulatory uncertainty could limit access, depending on your country. Low-liquidity markets might trap your funds in untradeable shares. Plus, crypto novices risk errors like sending USDC to the wrong address.

Mitigate these by researching markets, starting small, and staying informed on regulations. Polymarket’s decentralized appeal comes with these caveats.

4. Can I Trust Polymarket Outcomes?

Trust hinges on the UMA oracle’s accuracy. Most markets resolve smoothly, but high-stakes ones have sparked disputes. To build confidence, focus on markets with clear criteria (e.g., election results over vague events). Check Polymarket’s track record and community feedback.

It’s generally more transparent than centralized platforms, but not foolproof. Trust grows with experience and careful selection.

5. How Does Polymarket Compare to Other Prediction Markets?

Compared to Augur (Ethereum-based, higher fees) or Gnosis (broader but complex), Polymarket shines with usability and low costs. Its Polygon foundation and diverse markets set it apart, though oracle reliability remains a shared challenge.

For beginners, Polymarket’s simplicity wins. Seasoned users might explore competitors for niche features, but it’s a strong decentralized finance contender.

6. What’s the Future of Polymarket in 2025?

By 2025, expect Polymarket to refine its oracle system, possibly integrating AI for smarter predictions. Regulatory clarity could boost mainstream adoption, while new market types might emerge. Growth depends on fixing past hiccups, but its trajectory looks promising for blockchain betting fans.

Conclusion

Polymarket blends blockchain innovation with the age-old art of prediction, offering a transparent, decentralized way to bet on the future. From its low-fee structure to its diverse markets, it’s a compelling tool for 2025—though oracle risks remind us to tread carefully. As prediction markets evolve, Polymarket stands at the forefront, ready to shape how we see what’s next.