Are you eyeing ASML stock but unsure about diving into the unpredictable waters of the semiconductor market? You’re not alone. With technology evolving at breakneck speed and global economic shifts creating uncertainty, deciding whether to invest can feel overwhelming. This article offers a deep dive into ASML stock, exploring its recent performance, the forces driving its value, and what the future might hold for 2025. By the end, you’ll have a clear, actionable understanding to guide your investment choices.

Table of Contents

What is ASML?

ASML Holding N.V., headquartered in the Netherlands, is a titan in the semiconductor industry. It specializes in lithography systems—machines that etch intricate patterns onto silicon wafers to create microchips. ASML’s crown jewel is its extreme ultraviolet (EUV) lithography technology, which produces the tiniest, most advanced chips powering everything from smartphones to AI systems.

What sets ASML apart? It holds a near-monopoly on EUV machines, making it indispensable to chip giants like Intel, TSMC, and Samsung. This unique position fuels its influence and, by extension, its stock’s appeal.

Recent Stock Performance

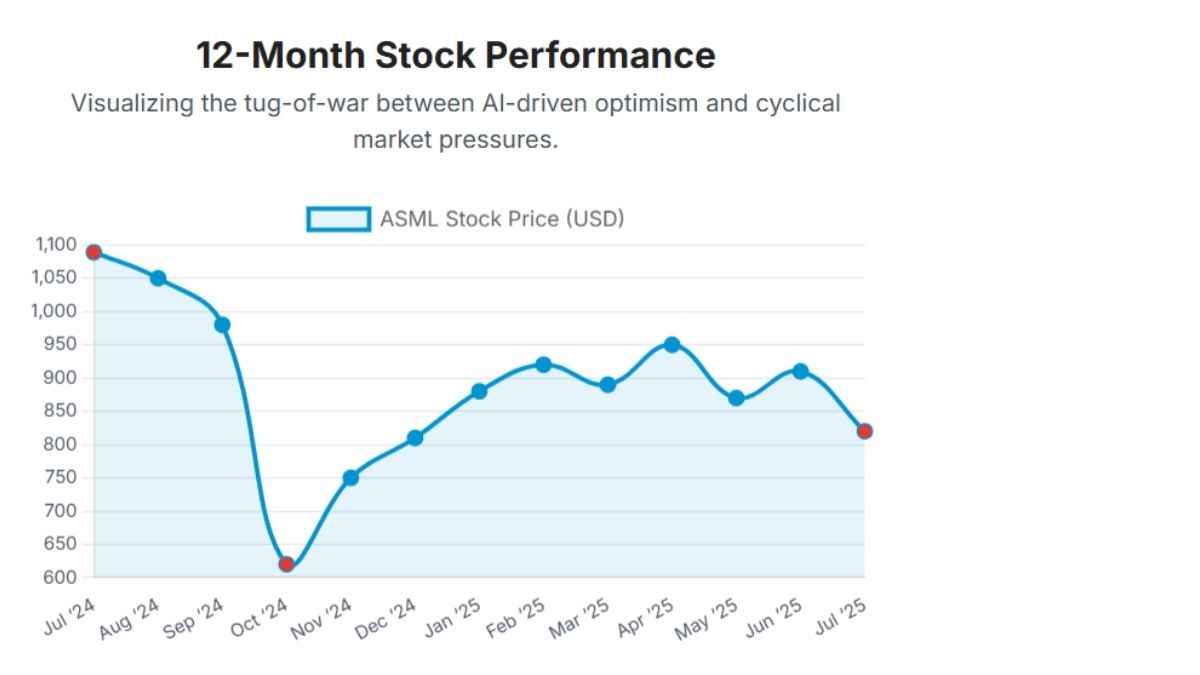

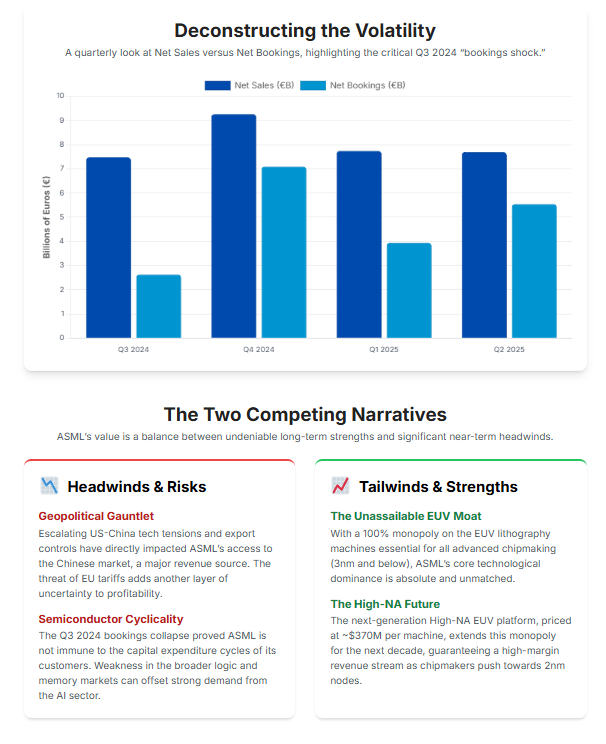

ASML’s stock has been a rollercoaster with a strong upward tilt in recent years. In Q2 2025, the company reported net sales of €7.7 billion, beating analyst forecasts of €7.2 billion. Net bookings soared to €5.5 billion, far exceeding the expected €4.19 billion, signaling robust demand for its machines. This performance reflects the insatiable global appetite for semiconductors, especially amid AI’s rise.

Read More: – Ethereum Explained: A Comprehensive Guide for 2025

Yet, it hasn’t been all smooth sailing. In October 2024, an accidental early release of Q3 results revealed a cautious 2025 sales forecast of €30-35 billion—below prior expectations. The stock plummeted 17% in a single day, a stark reminder of market sensitivity to guidance shifts. Despite this, ASML’s stock has trended upward over the past year, buoyed by long-term industry growth.

Factors Influencing ASML’s Stock

Several dynamics shape ASML stock performance:

- Global Chip Demand: The persistent chip shortage and rising needs in AI, 5G, and automotive sectors drive demand for ASML’s equipment.

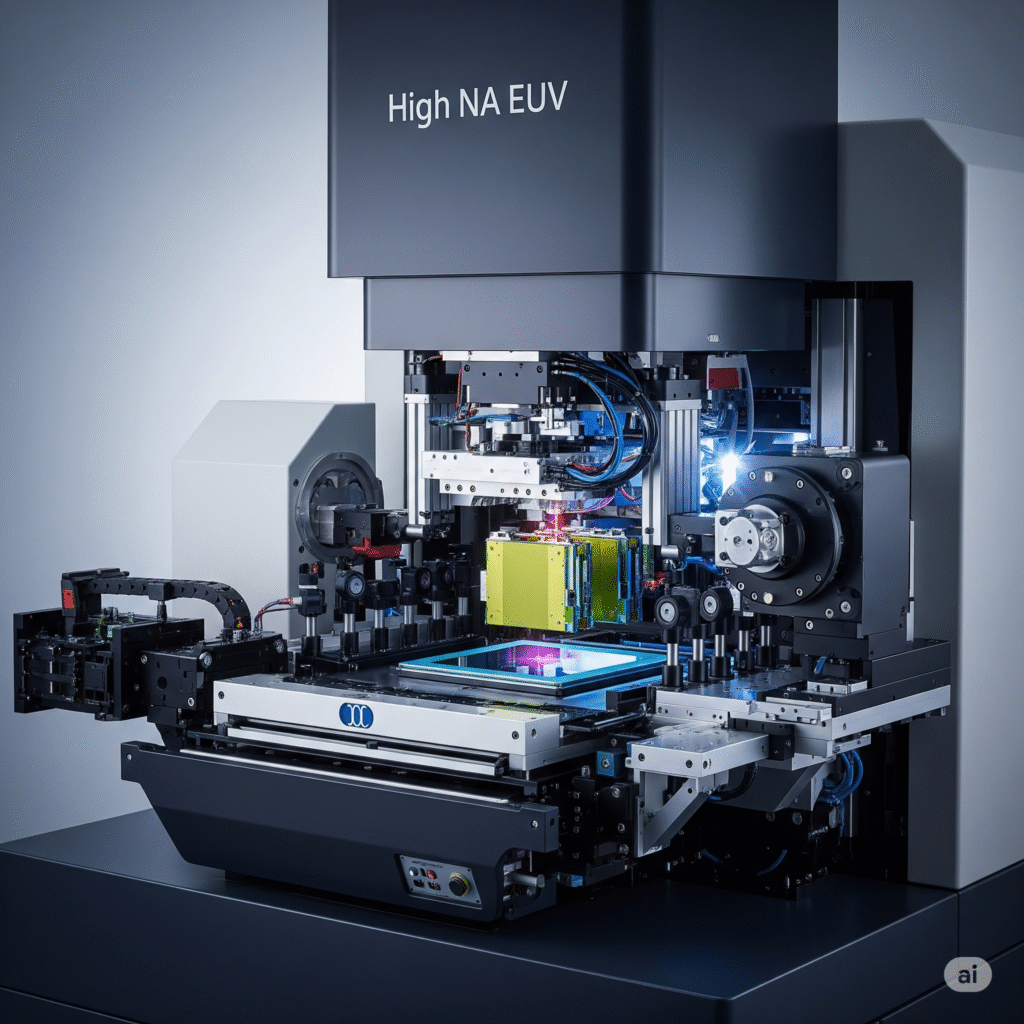

- Technological Edge: Innovations like High NA EUV systems keep ASML ahead, but delays could spook investors.

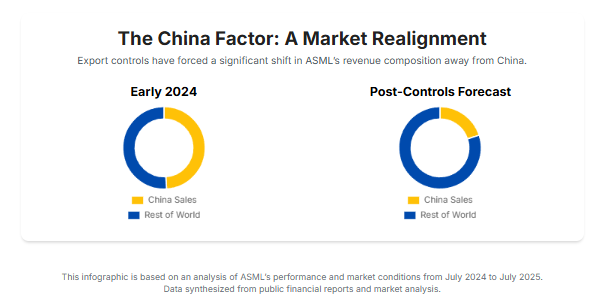

- Geopolitical Risks: U.S.-China trade tensions and export curbs, especially affecting ASML’s sales to China, pose challenges.

- Financial Strength: With steady revenue growth and a 52% gross margin forecast for 2025, ASML’s financials bolster investor confidence.

For instance, in 2024, tightened export restrictions to China dented ASML’s outlook, yet its CEO, Christophe Fouquet, highlighted AI as a counterbalancing growth driver.

Future Outlook

What’s next for ASML stock in 2025? Here’s the forecast:

- Industry Boom: The semiconductor market is projected to grow 10-15% annually, fueled by AI and IoT. ASML stands to gain as chipmakers scale up.

- Capacity Expansion: Plans to boost production and R&D spending signal revenue potential.

- Competitive Landscape: ASML’s EUV monopoly is unchallenged for now, but emerging rivals could disrupt this in the long term.

Analysts predict 15% sales growth in 2025, though management cautions about 2026 uncertainties. Geopolitical wildcards, like further China restrictions, remain a risk to monitor.

Also Read: – UNH Stock: Analysis, Trends & Investment Guide 2025

Investment Considerations

Thinking of investing in ASML stock? Weigh these factors:

Pros

- Dominant EUV market position.

- Strong demand tailwinds from tech trends.

- Proven innovation track record.

Cons

- Vulnerability to trade policies.

- Premium valuation may cap short-term gains.

- Reliance on key clients like TSMC and Samsung.

While ASML’s high price-to-earnings ratio might deter bargain hunters, its strategic role in tech makes it a long-term contender.

What’s New in 2025

In 2025, ASML unveiled its High NA EUV tool, a game-changer for producing sub-2nm chips. Shipped to select clients, this innovation promises to extend Moore’s Law and cement ASML’s leadership. Additionally, a partnership with imec to advance nanoelectronics research underscores its commitment to sustainable growth.

FAQ Section

1. Is ASML a Good Stock to Buy in 2025?

Deciding if ASML stock is a smart buy in 2025 hinges on your goals and risk appetite. ASML’s unrivaled role in the semiconductor ecosystem—supplying EUV machines to top chipmakers—makes it a standout. Its Q2 2025 results, with €7.7 billion in sales and a booming order book, highlight its strength amid AI-driven demand.

That said, risks loom. The October 2024 guidance cut showed how quickly sentiment can shift, and export restrictions to China could cap growth. If you’re in for the long haul and believe in tech’s expansion, ASML’s fundamentals are compelling. Short-term traders, however, might find its volatility and high valuation less appealing. Research thoroughly—perhaps check analyst reports on sites like Bloomberg—and consider professional advice tailored to your portfolio.

2. What Factors Affect ASML’s Stock Price?

ASML’s stock price dances to multiple tunes:

• Chip Demand: The global hunger for chips, from AI servers to electric vehicles, fuels ASML’s sales.

• Tech Innovation: Breakthroughs like High NA EUV can lift the stock; delays can sink it.

• Geopolitics: U.S.-led export limits to China, a major market, have already trimmed forecasts.

• Earnings: Strong financials, like a 52% margin, reassure investors.

Take 2024’s Q3 stumble: a weaker outlook tied to export curbs sent shares tumbling. Staying updated via sources like Reuters can help you anticipate such shifts.

3. How Does ASML’s Technology Impact Its Stock Performance?

ASML’s EUV technology is its golden ticket. It enables the smallest, most efficient chips—think 3nm and below—vital for next-gen tech. The 2025 High NA EUV launch amplifies this edge, promising even denser chips. When ASML nails these advances, its stock often surges as investors bet on future profits.

But there’s a flip side: R&D hiccups or production bottlenecks can dent confidence. In 2023, supply chain snags briefly slowed EUV deliveries, nudging the stock down. Tech leadership drives ASML’s valuation, making it a bellwether for industry health.

4. What Is the Future Outlook for ASML Stock?

The 2025 outlook for ASML stock is cautiously rosy. Analysts see 15% sales growth, fueled by a $39 billion order backlog and High NA EUV adoption. The semiconductor market’s upward trajectory—think AI, 5G, and beyond—plays to ASML’s strengths. Yet, management flags 2026 as uncertain, citing macro and geopolitical risks.

China remains a wildcard. If tensions ease, ASML could outperform; if they worsen, expect headwinds. Long-term, its monopoly and innovation pipeline suggest resilience. Track industry trends on platforms like Semiconductor Digest for deeper insights.

5. How Does ASML Compare to Other Semiconductor Stocks?

ASML isn’t a chipmaker—it’s the kingmaker. Unlike Nvidia (chip design) or TSMC (manufacturing), ASML provides the tools they all need. Its EUV monopoly sets it apart from equipment peers like Applied Materials, giving it a premium valuation—often 40x earnings versus the sector’s 30x.

This focus makes ASML less diversified but more pivotal. In 2024, while Nvidia soared on AI hype, ASML’s steadier gains reflected its foundational role. It’s less flashy but equally essential, appealing to investors seeking stability over speculation.

6. What Are the Risks of Investing in ASML Stock?

Investing in ASML comes with caveats:

• Trade Tensions: China sales, once 20% of revenue, are shrinking under export rules.

• Client Dependence: TSMC alone accounts for a hefty chunk of orders.

• Cyclicality: Semiconductor downturns could hit hard.

• Valuation: At a high P/E, there’s little room for error.

The 2024 guidance slip showed how fast sentiment can sour. Diversifying your portfolio and monitoring news from outlets like CNBC can mitigate these risks.

Conclusion

ASML stock offers a front-row seat to the semiconductor revolution. Its EUV dominance and the tech world’s chip obsession position it for growth, yet geopolitical and valuation hurdles loom. Whether you’re a seasoned investor or a curious newbie, understanding ASML’s strengths and risks is key. What’s your take? Drop a comment, share this with fellow investors, or sign up for our newsletter for more market insights!