The bitcoin price has been on an exhilarating ride, with recent hikes captivating investors and sparking widespread curiosity. In mid-2025, Bitcoin soared to new all-time highs, briefly touching $118,000, driven by a mix of institutional adoption, regulatory shifts, and bullish market sentiment. Whether you’re an investor tracking BTC price trends or simply intrigued by cryptocurrency, this article dives into the reasons behind the bitcoin price hike, offers expert insights, and explores what it means for the future. Let’s unpack the forces fueling this surge and how you can navigate the evolving world of BTC.

Table of Contents

Factors Contributing to the Bitcoin Price Hike

Several key drivers have propelled the bitcoin price to unprecedented levels. Here’s a detailed look at the primary factors:

Institutional Adoption

Institutional investment has emerged as a cornerstone of the bitcoin price surge. Major corporations like Tesla, MicroStrategy, and Square have poured billions into BTC, signaling strong confidence in its long-term potential. In 2025, this trend has intensified, with companies like MicroCloud Hologram investing up to $200 million in Bitcoin and crypto-related securities. These moves not only boost demand but also lend credibility to cryptocurrency as a legitimate asset class.

- Real-World Example: When MicroCloud Hologram announced its Bitcoin investment in early 2025, its stock surged by 30%, illustrating how corporate adoption can amplify both bitcoin price usd and equity markets.

For more on institutional trends, check out CoinDesk’s latest analysis.

Regulatory Changes

Regulatory developments have significantly influenced the bitcoin price hike. In 2025, the U.S. has embraced a pro-crypto stance under President Donald Trump, establishing a strategic Bitcoin reserve and passing the GENIUS Act to encourage innovation. The approval of Bitcoin ETFs in the U.S. and Canada has also opened the floodgates for institutional and retail investors, driving up BTC usd values.

- Global Perspective: El Salvador’s continued use of Bitcoin as legal tender and Russia’s exploration of BTC for international trade have further solidified its global standing.

Market Sentiment and Macro Trends

Market sentiment has turned overwhelmingly positive, with investors viewing Bitcoin as a hedge against inflation and a store of value. In 2025, a weakening U.S. dollar—due to the Federal Reserve pausing rate hikes—has made non-yielding assets like Bitcoin more appealing. Social media platforms like X have buzzed with optimism, with users noting Bitcoin’s resilience near all-time highs.

- Social Media Insight: A post from @BCBacker on X highlighted Bitcoin’s flirtation with $110,000, predicting further gains based on market momentum.

Read More: – USPS Stamp Price Hike 2025: New Rates & What It Means

Interpreting Bitcoin Price Charts: Key Indicators to Watch

For investors, understanding bitcoin price charts is essential. Here are the key indicators to monitor:

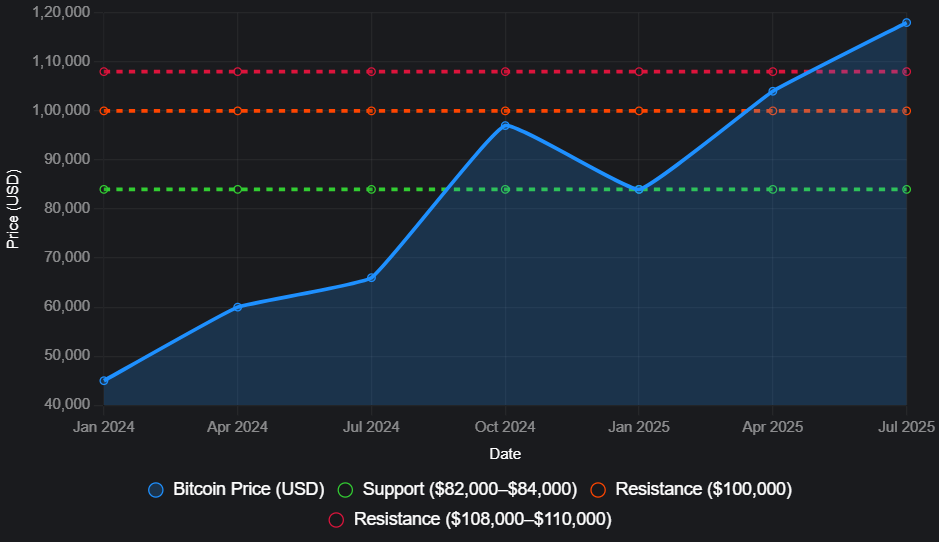

- Moving Averages (MA): A rising 50-day MA signals bullish momentum. In July 2025, Bitcoin reclaimed its 50-day SMA around $106,000, confirming upward strength.

- Relative Strength Index (RSI): An RSI above 70 indicates overbought conditions, while below 30 suggests oversold. Bitcoin’s RSI recently hovered near 60, reflecting sustainable growth.

- Trading Volume: High volume during price increases validates bullish trends. Bitcoin ETFs saw a record $1.18 billion inflow in July 2025, underscoring robust demand.

Why Is Bitcoin Going Up? A Closer Look

The question “why is bitcoin going up?” dominates search queries, and the answer lies in a blend of supply-demand dynamics and external catalysts:

- Scarcity: Bitcoin’s capped supply of 21 million coins creates scarcity. Exchange reserves dropped to 2.4 million BTC in 2025, down from 3.1 million in 2024, indicating accumulation.

- Macro Factors: Persistent inflation and a dovish Federal Reserve have driven investors to Bitcoin as a safe haven.

- Tech Advances: Improvements in blockchain scalability, like the Lightning Network, enhance Bitcoin’s utility, boosting its appeal.

Also Read: – Ethereum Projections 2025: Price, Trends & Tech Insights

Bitcoin Price Predictions for 2025

Experts offer varied forecasts for the bitcoin price:

- Bullish Case: Keith Alan’s “Cup & Handle” analysis suggests a $145,000 target by year-end, while Russian analysts predict $150,000.

- Bearish Risks: Market saturation or competition from altcoins could trigger a pullback.

Bitcoin Price Forecasts Table

| Source | Prediction | Rationale |

|---|---|---|

| Coinpedia | $135,000 | Institutional demand, policy support |

| 10x Research | $133,000 | ETF inflows, bullish trends |

| Rosenberg Research | $143,000 | Macro catalysts |

| CryptoQuant | Pullback Risk | Stalling MVRV ratio |

How to Invest in Bitcoin Safely

Ready to ride the bitcoin price wave? Here’s how to start:

- Exchanges: Use trusted platforms like Coinbase or Binance to buy BTC.

- ETFs: Bitcoin ETFs offer exposure without managing wallets.

- Diversification: Balance cryptocurrency with other assets to reduce risk.

- Stay Updated: Follow crypto news on sites like CryptoSlate.

Frequently Asked Questions (FAQs)

Why is Bitcoin’s price going up?

The bitcoin price is surging due to multiple factors converging in 2025. Institutional adoption has been a major driver, with companies like Tesla and MicroCloud Hologram investing heavily, signaling confidence in BTC. Regulatory clarity, such as the U.S. establishing a Bitcoin reserve and approving ETFs, has made it easier for investors to enter the market, boosting demand. Additionally, positive market sentiment—fueled by a weakening dollar and inflation fears—has positioned Bitcoin as a hedge, driving the bitcoin price usd higher. Scarcity also plays a role, with exchange reserves dropping to 2.4 million BTC, indicating strong accumulation. These elements collectively explain why bitcoin is going up.

How can I invest in Bitcoin?

Investing in Bitcoin is straightforward but requires caution. You can buy BTC directly through exchanges like Coinbase, Binance, or Kraken, which offer user-friendly platforms for trading bitcoin price usd. Alternatively, Bitcoin ATMs allow cash purchases, though fees can be higher. For a hands-off approach, Bitcoin ETFs—available in the U.S. and Canada—let you invest via traditional brokerage accounts. Before diving in, research each option, set up a secure wallet, and only invest what you can afford to lose, given Bitcoin’s volatility. Stay informed with bitcoin news to time your entry wisely.

What are the risks of investing in Bitcoin?

Investing in Bitcoin carries notable risks. Price volatility is a primary concern—the bitcoin price can swing dramatically, as seen in past corrections. Regulatory uncertainty also looms; while 2025 has brought pro-crypto policies in the U.S., crackdowns elsewhere (e.g., China) could impact BTC usd. Security risks, like exchange hacks or lost private keys, threaten funds if not managed properly. Additionally, market saturation or competition from altcoins could dilute Bitcoin’s dominance. Investors must weigh these factors and approach cryptocurrency with a clear risk management strategy.

What is the future of Bitcoin?

The future of Bitcoin is promising yet uncertain. Optimists see it hitting $150,000 by late 2025, driven by institutional adoption and global acceptance, such as Russia’s trade experiments. Technological upgrades, like faster transactions via the Lightning Network, could further elevate BTC price. However, challenges persist—regulatory shifts, altcoin competition, and macroeconomic changes could alter its trajectory. Staying updated via crypto news and understanding market trends will be key to predicting where the bitcoin price heads next.

How does Bitcoin’s price in USD affect global markets?

The bitcoin price usd increasingly influences global markets. As a leading cryptocurrency, a rising Bitcoin price often signals risk-on sentiment, boosting tech stocks and alternative assets. In 2025, its correlation with equity markets has grown due to institutional involvement. Conversely, sharp declines can trigger sell-offs in risk assets. Its role as an inflation hedge also impacts currency markets, particularly as the dollar weakens. The BTC price thus serves as both a barometer and catalyst for broader financial trends.

What is Crypto Week, and how does it impact Bitcoin?

Crypto Week refers to high-impact periods in the cryptocurrency space, often tied to events like regulatory announcements or market milestones. These weeks amplify volatility in the bitcoin price, as seen during the 2024 halving, which preceded a rally. In 2025, events like ETF approval spikes or policy shifts have sparked crypto week buzz, driving BTC trading volume and price swings. Monitoring bitcoin news during these periods can help investors capitalize on opportunities or avoid pitfalls.

What’s New in 2025

In 2025, Bitcoin’s landscape has evolved significantly:

- Policy Shifts: The U.S. Bitcoin reserve and GENIUS Act have turbocharged adoption.

- Tech Upgrades: The Lightning Network has slashed transaction costs, enhancing usability.

- Global Moves: Russia’s trade trials and corporate investments signal broader acceptance.

These developments underscore Bitcoin’s growing influence, potentially paving the way for further bitcoin price gains.

Conclusion

The bitcoin price hike in 2025 reflects a dynamic interplay of institutional adoption, regulatory support, and macroeconomic shifts. From hitting $118,000 to reshaping global markets, Bitcoin continues to captivate and challenge investors. Whether you’re tracking BTC price usd or exploring cryptocurrency for the first time, staying informed is crucial. What are your thoughts on the bitcoin price surge? Drop a comment below or sign up for our newsletter for the latest crypto news and insights!