The world of technology stocks is no stranger to volatility, but when a micro-cap company like Cyngn Inc. (NASDAQ: CYN) sees its stock price soar by as much as 130% in a single day, investors take notice. On June 26, 2025, CYN stock captured headlines with a dramatic premarket surge, reportedly jumping from $5.01 to $9.53, and possibly reaching as high as $14.93 during trading hours, according to some social media posts on X (Investing.com). This spike was largely attributed to Cyngn’s high-profile collaboration with NVIDIA, showcased at the Automatica 2025 robotics and automation trade fair. But what does this mean for investors? Is CYN stock a fleeting opportunity or a long-term investment worth considering? This article explores Cyngn’s business, recent developments, financial performance, and the broader market context to provide a comprehensive view for investors.

Table of Contents

Understanding Cyngn Inc.

Company Overview

Cyngn Inc., headquartered in Menlo Park, California, is a technology company focused on autonomous vehicle solutions for industrial applications. Founded in 2013, Cyngn develops the Enterprise Autonomy Suite, which includes its flagship DriveMod software, a modular autonomous driving platform. DriveMod can be integrated into vehicles manufactured by original equipment manufacturers (OEMs) like Motrec and BYD, either through retrofitting existing vehicles or during assembly. This flexibility allows Cyngn to target industries such as manufacturing, logistics, consumer packaged goods (CPG), and defense, where automation is increasingly critical (Cyngn Website).

Cyngn’s autonomous mobile robots (AMRs), such as tuggers and forklifts, are designed to handle demanding tasks like hauling up to 12,000 pounds, navigating complex environments, and switching between autonomous and manual modes. The company’s Cyngn Insight fleet management system (FMS) provides real-time monitoring and data analytics, while Cyngn Evolve supports AI and machine learning to enhance algorithms and validate new releases. These tools aim to reduce labor costs, increase operational efficiency, and improve workplace safety.

Key Partnerships

Cyngn collaborates with established OEMs to ensure its AMRs are built on reliable platforms. Notable partners include:

- Motrec: A manufacturer of industrial vehicles, providing robust platforms for Cyngn’s autonomous tuggers.

- BYD: A global leader in electric vehicles, enhancing Cyngn’s offerings with advanced battery technology.

- Arauco and Coats: Customers who have adopted Cyngn’s technology, demonstrating its real-world applicability.

These partnerships underscore Cyngn’s strategy to leverage existing infrastructure, making its solutions scalable and cost-effective.

Recent Developments Driving CYN Stock

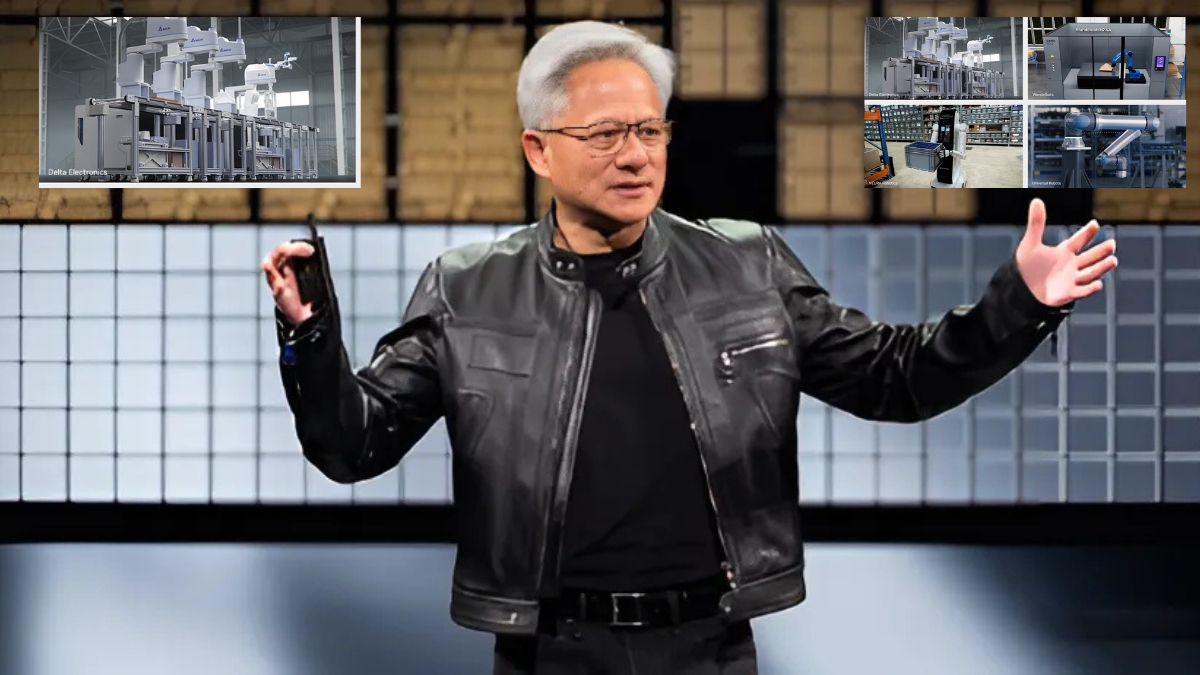

NVIDIA Collaboration and Automatica 2025

The catalyst for the recent CYN stock surge was Cyngn’s collaboration with NVIDIA, announced on June 26, 2025, as part of the Automatica 2025 showcase in Munich, Germany (PR Newswire). Cyngn was featured in an NVIDIA blog post as one of a select group of robotics innovators using the NVIDIA Isaac platform to develop autonomous solutions for industrial applications (NVIDIA Blog). The Isaac platform provides advanced AI, simulation, and perception tools, enabling Cyngn to enhance its DriveMod software with cutting-edge capabilities like 360° awareness and real-time decision-making.

Lior Tal, Cyngn’s CEO, highlighted the significance of this partnership, stating, “This collaboration with NVIDIA helps reinforce our mission to build cutting-edge autonomous vehicles that deliver real-world ROI to industrial operators” (Investing.com). The announcement coincided with a reported 90–130% stock price increase, with premarket trading on June 26, 2025, showing a jump from $5.01 to $9.53, and some X posts suggesting prices as high as $14.93 (X Post). While these higher figures lack confirmation from primary financial sources, the high trading volume—reportedly exceeding the 1.6 million share float—indicates significant market interest (X Post).

Other Milestones

Beyond the NVIDIA partnership, Cyngn has achieved several milestones in 2025:

- New Patent: Cyngn received its 22nd U.S. patent for a cloud-based autonomous vehicle operation system, enabling cost-effective vehicles with sophisticated driving capabilities (StockTitan).

- Customer Wins: The company secured contracts with major automotive OEMs and a Fortune 500 supplier, expanding its presence in the U.S. and Mexico.

- Funding: In December 2024, Cyngn raised $33 million to scale customer deployments, bolstering its financial position (StockTitan).

- Management Changes: The appointment of Marty Petraitis as VP of Sales and Natalie Russell as CFO signals a focus on growth and operational efficiency.

These developments reflect Cyngn’s momentum in commercializing its technology and expanding its market reach.

Financial Performance: Q1 2025 Insights

Q1 2025 Earnings Highlights

Cyngn’s Q1 2025 financial results, released on May 7, 2025, provide a snapshot of its financial health (PR Newswire). Key metrics include:

| Metric | Q1 2025 | Q1 2024 | Change |

|---|---|---|---|

| Revenue | $47,200 | $5,500 | +758.2% |

| Net Loss | ($7.6 million) | ($6.0 million) | +26.7% |

| Total Costs | $5.3 million | $6.0 million | -11.8% |

| New Bookings | $308,000 | Not reported | N/A |

| Cash Position | $16.3 million | Not reported | N/A |

| Debt | $0 | Not reported | N/A |

- Revenue Growth: The significant increase from $5,500 to $47,200 reflects growing adoption of Cyngn’s DriveMod vehicles, particularly in the automotive sector.

- Net Loss: The $7.6 million loss, up from $6.0 million, is attributed to higher general and administrative expenses, likely due to investments in scaling operations.

- Cost Reduction: A 11.8% decrease in total costs to $5.3 million indicates improved operational efficiency.

- Cash Position: With $16.3 million in cash and no debt, Cyngn has a solid runway to support further development and deployments.

Stock Splits and Market Cap

Cyngn underwent two reverse stock splits to maintain Nasdaq compliance: a 1-for-100 split effective July 3, 2024, and a 1-for-150 split effective February 18, 2025 (PR Newswire). These splits increased the per-share price, with the stock trading around $4.15–$5.01 before the June 26 surge. With 1.75 million shares outstanding, the market cap was approximately $7.27 million at a $4.15 share price (Morningstar). Post-surge estimates suggest a market cap of $16.68–$26.13 million, depending on the stock price ($9.53–$14.93).

Market Potential: The Industrial AMR Landscape

The industrial autonomous mobile robot (AMR) market is experiencing robust growth, driven by labor shortages, rising operational costs, and advancements in AI and robotics. Market projections vary but highlight significant opportunities:

| Source | Market Size 2025 | Market Size 2030 | CAGR |

|---|---|---|---|

| Grand View Research | $4.74 billion | $9.56 billion | 15.1% |

| MarketsandMarkets | $2.25 billion | $4.56 billion | 15.1% |

| IndustryARC | Not specified | $14.4 billion | 21.4% |

- Grand View Research projects the AMR market to reach $9.56 billion by 2030 (Grand View Research).

- MarketsandMarkets estimates a $4.56 billion market by 2030, emphasizing AMRs’ adaptability in manufacturing and logistics (MarketsandMarkets).

- IndustryARC forecasts a higher $14.4 billion by 2030, driven by AMRs’ integration into diverse industries (IndustryARC).

Cyngn’s focus on industrial AMRs, combined with its NVIDIA partnership, positions it to capture a share of this growing market. The company’s ability to deploy AMRs without special infrastructure and its emphasis on safety and scalability align with industry trends.

Case Studies: Real-World Impact

Cyngn’s technology delivers measurable benefits, as evidenced by customer case studies:

| Customer | Loss Avoidance | Payback Period |

|---|---|---|

| Building Materials Manufacturer | $4 million | 12 months |

| OEM Parts Distributor | $1.75 million | 21 months |

| HVAC Manufacturer | $1.2 million | 16 months |

| Consumer Packaged Goods | $945,000 | 15 months |

- Efficiency Gains: Deployments have led to a 33% increase in productivity and a 64% reduction in labor costs, according to Cyngn’s research (Cyngn Website).

- Rapid Deployment: AMRs can be operational in days, requiring no magnetic strips or special infrastructure.

- Safety Features: Features like 360° awareness with 3D LiDAR and audio-visual cues enhance workplace safety.

These results demonstrate Cyngn’s ability to deliver tangible ROI, making its technology attractive to industries facing labor and cost challenges.

Analysis: Why the Surge and What’s Next?

Drivers of the Stock Surge

The 90–130% surge in CYN stock on June 26, 2025, can be attributed to several factors:

- NVIDIA Partnership: The collaboration with NVIDIA, a tech industry leader, validates Cyngn’s technology and boosts investor confidence.

- Automatica 2025 Exposure: Being featured at a premier robotics event increases Cyngn’s visibility and credibility.

- Market Sentiment: High trading volume, exceeding the 1.6 million share float, reflects strong market interest (X Post).

- Industry Trends: The growing demand for industrial automation aligns with Cyngn’s offerings, fueling optimism.

Risks and Considerations

Despite the excitement, investors should consider:

- Financial Losses: Cyngn’s $7.6 million net loss in Q1 2025 indicates it’s not yet profitable, posing risks for long-term sustainability.

- Stock Volatility: The rapid price surge and discrepancies in reported prices (e.g., $9.53 vs. $14.93) suggest potential volatility.

- Competition: The AMR market is competitive, with players like Universal Robots and KUKA also leveraging advanced technologies (NVIDIA Blog).

- Micro-Cap Risks: With a market cap of $7.27–$26.13 million, CYN stock is susceptible to sharp price swings.

Future Outlook

Cyngn’s future looks promising, given its strategic partnerships, growing customer base, and the expanding AMR market. The $33 million funding round in December 2024 and a strong cash position provide resources to scale deployments. Upcoming milestones, such as the next earnings report on August 6, 2025, and further developments at Automatica 2025, will be critical to watch (TradingView). Analysts have set a $12 price target, suggesting upside potential, though the company’s weak financial health score warrants caution (Investing.com).

FAQ Section

1. What does Cyngn Inc. do?

Cyngn Inc. develops autonomous vehicle technology tailored for industrial applications, such as manufacturing and logistics. Its Enterprise Autonomy Suite includes DriveMod, a modular software that enables vehicles like tuggers and forklifts to operate autonomously. These AMRs can haul heavy loads, navigate complex environments, and switch between autonomous and manual modes, reducing labor costs and improving efficiency. Cyngn Insight provides fleet management and analytics, while Cyngn Evolve supports AI development. By partnering with OEMs like Motrec and BYD, Cyngn ensures its solutions are scalable and reliable, addressing labor shortages and safety challenges in industries like automotive and CPG (Cyngn Website).

2. Why did CYN stock surge recently?

On June 26, 2025, CYN stock surged by 90–130%, with premarket prices reportedly rising from $5.01 to $9.53, and some X posts suggesting peaks of $14.93 (Tokenist). The surge was driven by Cyngn’s collaboration with NVIDIA, announced at Automatica 2025. Cyngn was highlighted in an NVIDIA blog post as a key innovator using the Isaac platform, boosting its credibility and market visibility. High trading volume, exceeding the 1.6 million share float, reflects strong investor interest, though unverified price reports suggest caution (X Post).

3. What is the significance of Cyngn’s collaboration with NVIDIA?

Cyngn’s collaboration with NVIDIA, showcased at Automatica 2025, leverages the NVIDIA Isaac platform to enhance its DriveMod software. This platform provides advanced AI, simulation, and perception tools, enabling Cyngn’s AMRs to achieve superior navigation and safety features, such as 360° awareness and real-time decision-making. The partnership validates Cyngn’s technology, positioning it among leading robotics innovators and increasing its appeal to industrial clients. This exposure could drive further customer adoption and revenue growth, making it a pivotal moment for Cyngn’s market presence (PR Newswire).

4. What are the financial highlights of Cyngn’s Q1 2025 earnings?

Cyngn’s Q1 2025 earnings, reported on May 7, 2025, showed revenue of $47,200, up 758.2% from $5,500 in Q1 2024, driven by increased DriveMod vehicle deployments. The company secured $308,000 in new bookings, indicating growing demand. However, a net loss of $7.6 million, up from $6.0 million, reflects higher administrative expenses. Total costs dropped 11.8% to $5.3 million, showing improved efficiency. With $16.3 million in cash and no debt, Cyngn has a solid financial runway to support growth, though profitability remains a challenge (PR Newswire).

5. How does Cyngn’s technology benefit industrial organizations?

Cyngn’s AMRs, powered by DriveMod, automate material handling tasks, offering a 33% productivity increase and 64% labor cost reduction, per company research. They require no special infrastructure, enabling deployment in days. Safety features like 3D LiDAR and audio-visual cues minimize workplace risks. Case studies show significant loss avoidance—$4 million for a building materials manufacturer with a 12-month payback—demonstrating rapid ROI. These benefits address labor shortages and operational inefficiencies in industries like manufacturing and logistics (Cyngn Website).

6. What is the future outlook for Cyngn Inc.?

Cyngn’s outlook is optimistic due to its NVIDIA partnership, $33 million funding, and the growing AMR market, projected to reach $4.56–$14.4 billion by 2030. Expansion into new sectors like defense and logistics, along with new patents, strengthens its position. However, ongoing losses and competition pose risks. Investors should watch for the August 6, 2025, earnings report and further customer wins to gauge Cyngn’s path to profitability (Grand View Research).

Conclusion

Cyngn Inc. is carving a niche in the industrial AMR market with its innovative DriveMod technology and strategic partnerships, notably with NVIDIA. The recent CYN stock surge reflects market excitement, but investors should weigh the company’s growth potential against its financial challenges. With a robust cash position and a rapidly expanding market, Cyngn offers an intriguing opportunity for those interested in AI and robotics. Stay informed by following Cyngn’s updates on their investor relations page (Cyngn IR) and share your thoughts in the comments below!